The Nevada Legislature re-wrote the child support statutes, including the formulas to calculate the same. These new guidelines are codified in Nevada Administrative Code (NAC) section 425 and became effective February 2020. While many aspects surrounding child support have changed, the formulas and guidelines still use the gross, pre-tax (or adjusted gross for self-employed parents) monthly income of the obligor.

Child Support Formulas

Most shocking and relevant are the changes made to the formula calculating the obligation amount. Under the new child support guidelines, the calculation of an obligor’s (the paying parent) child support breaks down as follows:

⦁ For one child:

(a) 16% of the first $6,000 of gross monthly income;

(b) 8% of gross monthly income between $6,000 and $10,000; and

(c) 4% of gross monthly income that is greater than $10,000.

⦁ For two children:

(a) 22% of the first $6,000 of gross monthly income;

(b) 11% of gross monthly income between $6,000 and $10,000; and

(c) 6% of gross monthly income greater than $10,000.

⦁ For three children:

(a) 26% of the first $6,000 of gross monthly income;

(b) 13% of gross monthly income between $6,000 and $10,000; and

(c) 6% of gross monthly income greater than $10,000.

⦁ For four children:

(a) 28% of the first $6,000 of gross monthly income;

(b) 14% of gross monthly income between $6,000 and $10,000; and

(c) 7% gross monthly income greater than $10,000.

⦁ For each additional child:

(a) An additional 2% of the first $6,000 of gross monthly income per child;

(b) An additional 1% of gross monthly income between $6,000 and $10,000 per child; and

(c) An additional 0.5% of gross monthly income greater than $10,000 per child.

For perspective, here are some examples (assuming there is only one child):

⦁ If the parent obligated to pay child support has a gross monthly income of $5,800, that parent’s child support obligation is calculated as follows:

5800 x 0.16 = 928

Their child support is $928.00 per month.

⦁ If that parent’s gross month income is $8,200, we calculate 16% of their income between $0 and $6,000, then 8% of the amount between $6,000 – $10,000, and combine the two, as follows:

x 0.08 = 960

2200 (the difference between 6000 & 8200) x 0.08 = 176

960 + 176 = 1136

Their child support amount would be $1,136 per month.

⦁ If the parent’s gross monthly income is $15,000, performing the same tiered calculation as example B above yields the following result:

6000 x 0.16 = 960

4000 (the difference between 6000 & 10000) x 0.08 = 320

5000 (the difference between 10000 & 15000) x 0.04 = 200

960 + 320 + 200 = 1480

Their child support is $1,480 per month.

What about Joint Physical Custody?

In addition to the guidelines for child support in Nevada, there are two Nevada Supreme Court cases of Wright v. Osburn, 114 Nev. 1367, 970 P.2d 1071 (1998), and Wesley v. Foster, 119 Nev. 110, 65 P.3d 251 (2003), which are still good law as it relates to the calculation of child support for a joint physical custody arrangement. Under these cases, one must first apply the child support formulas to each of the parties’ gross monthly income, then offset the parties’ respective obligations against each other. The difference resulting therefrom is the child support obligation owed from the higher-income earner to the other parent.

Again, for perspective, assume Parent A and Parent B share joint physical custody of their one child.

Parent A earns a gross monthly income of $15,000. Parent B earns a gross monthly income of $5,800. As we established above, Parent A’s obligation would be $1,480.

Parent B’s obligation would be $928.

1480 – 928 = 552

Parent A’s child support is $552 per month.

For a quick calculator for both primary and joint physical custody arrangements, use this calculator.

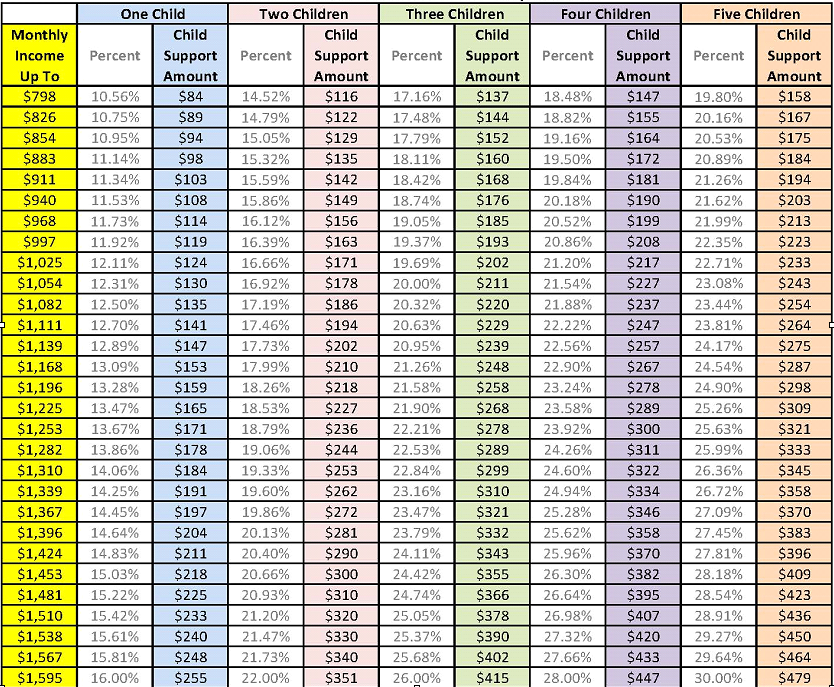

Low-Income Earners

There are no longer any presumptive maximum amounts. The final percentage bracket of 4% continues into perpetuity, however high an income earner’s gross monthly income may be.

However, the Nevada Legislature acted to protect low-income earners and establish a low-income schedule through NAC 425.145. The Administrative Office of the Courts must publish this low-income schedule on or before March 31 of each year. This schedule establishes different percentage rates than those set forth above for any obligor whose gross monthly income is at $1,595 or less.

The low-income schedule will be released annually and can be found here.

Child Support “adjustments”

In addition to protecting low-income earners, NAC 425 also provides consideration for additional expenses incurred by either parent and allows for adjustments accordingly.

NAC 425.130 provides consideration for the costs of childcare paid by either or both parties. The court is now required to take into consideration “the reasonable costs of childcare paid by either or both parties and make an equitable division thereof.” Therefore, if a party is paying the costs of childcare, which are deemed to be reasonable, their child support obligation may be reduced, or their child support income may be increased accordingly.

NAC 425.150 also provides for “adjustments” to the child support formula set forth herein. The specific needs of child and economic circumstances of parties are taken into consideration by the Court for such adjustments. NAC 452.150(1) sets forth the following factors and specific findings of fact for the court to consider:

⦁ Any special educational needs of the child;

⦁ The legal responsibility of the parties for the support of others;

⦁ The value of services contributed by either party;

⦁ Any public assistance paid to support the child;

⦁ The cost of transportation of the child to and from visitation;

⦁ The relative income of both households so long as the adjustment does not exceed the total obligation of the other party;

⦁ Any other necessary expenses for the benefit of the child; and

⦁ The obligor’s ability to pay.

NAC 425.150(2) also allows the Court to consider “any benefits received by a child pursuant to 42 U.S.C. § 402(d) based on a parent’s entitlement to federal disability or old-age insurance benefits pursuant to 42 U.S.C. §§ 401 to 433, inclusive, in the parent’s gross income and adjust an obligor’s child support obligation by subtracting the amount of the child’s benefit. In no case may this adjustment require an obligee to reimburse an obligor for any portion of the child’s benefit.”

Child Support for Low Income

LOW INCOME CHILD SUPPORT SCHEDULE

FOR PARENTS WHO EARN LESS THAN $1595 PER MONTH

© 2020 Family Law Self-Help Center Child Support Worksheet

https://www.familylawselfhelpcenter.org/images/forms/divorce/divorce-complaint-kids-pdf.pdf